In late 2022, the Consolidated Appropriations Act of 2023 was passed. A section of the legislation, known as the SECURE Act 2.0, provides new opportunities for charitable giving, such as a legacy IRA.

IRA Gifts Through a Qualified Charitable Distribution Remain Attractive

If you are age 70½ or older, you can make a qualified charitable distribution (QCD) directly from your IRA.

Consider the benefits:

- No tax is due on the distribution up to the $100,000 annual aggregate limit. (Note that contributions to an IRA after age 70½ count against QCD amounts.)

- The gift counts toward your required minimum distribution (RMD) if one is due (generally age 73 or over).

- Your gift makes an immediate impact on UT Southwestern.

A New Option

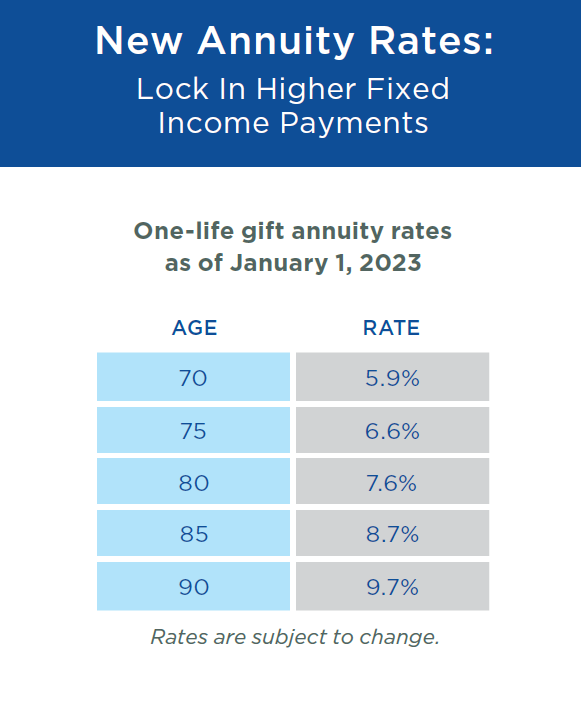

IRA owners age 70½ or over have a new option to consider as well. The SECURE 2.0 legislation now allows a one-time, tax-free distribution (up to $50,000) from your IRA to fund a charitable gift annuity or charitable remainder trust. This is a great time to explore establishing a charitable gift annuity, as rates have recently increased.

A Legacy Gift

We welcome gifts that make an immediate impact, and we also appreciate future gifts that help ensure the continuation of our work. Consider benefiting UT Southwestern by adding Southwestern Medical Foundation as a beneficiary of your IRA. We pay no tax on the gift—the entire amount is available for use

by UT Southwestern. Be sure to consult your tax and financial advisors when considering any planned gift.

Start the Conversation

Planned giving is an important part of your retirement plans. This new legislation brings an opportunity to review your retirement strategy and its potential impact on your charitable giving. We at Southwestern Medical Foundation will be happy to discuss how your charitable giving can be enhanced by the new laws. Please contact us to arrange a time to have a conversation.

To contact Randy Daugherty, please call (214) 648-3069 or email him at randal.daugherty@utsouthwestern.edu.

Receive your complimentary information booklet about Secure Act 2.0.

This information is not tax, legal or financial advice. Consult your tax advisor for information specific to your situation.

About the Author

Since 2000, Randy Daugherty has served as Director of Gift Planning for Southwestern Medical Foundation and UT Southwestern Medical Center. He works with donors to suggest bequest language to share with attorneys, establish charitable gift annuities and charitable remainder trusts, utilize beneficiary designations for retirement plan accounts and explore gifts of other non-cash assets like real estate and life insurance. After receiving a Master of Divinity degree from Vanderbilt University, Randy began a career in development, working in higher education, the arts and in academic medicine. He received the Chartered Advisor in Philanthropy designation (CAP) through the American College of Financial Services.