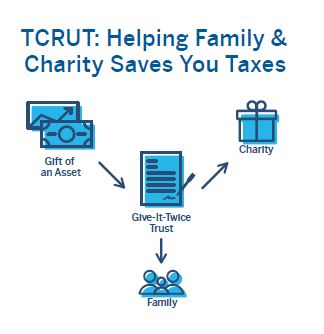

Are you looking for a way to help secure your family’s future while making a gift to charity? It’s possible to achieve these goals and enjoy valuable income and estate tax savings with a give-it-twice-trust, also known as a testamentary charitable remainder unitrust (TCRUT).

The Testamentary Charitable Remainder Unitrust (TCRUT) can be a powerful estate planning tool to accomplish the following:

- Provide your heirs with an inheritance in an appropriate amount and manner.

- Reduce estate and income taxes.

- Leave a significant legacy to your favorite charities.

How Does a TCRUT Work?

A TCRUT is a trust that makes payments to one or more beneficiaries. At the end of the trust, the remaining principal is distributed to one or more charities. You decide:

- WHO will be the income beneficiaries

- HOW much, how often, and for how long the income payments will be made.

- WHICH charities will be the remainder beneficiaries

When you pass away, your executor or trustee will transfer the assets you have selected to the charitable trust. The trust will pay income to your spouse, children and/or other individual beneficiaries that you designate for their lives or for a term of up to 20 years. The balance of the trust assets will go to support your cause.

What Assets Can Be Used to Fund the Trust?

Most assets, such as cash or cash equivalents, securities and real estate, may be used to fund your charitable trust. Funding this trust with your IRA provides an additional tax benefit—your heirs can receive tax-efficient income with the friendly charitable trust rules and avoid the income tax other due if they had received an IRA distribution. It is simple to fund this plan with your IRA by designating your charitable trust as an IRA beneficiary.

An Example of a TCRUT

Grandma would like to leave an appreciated capital asset worth $500,000 to her grandkids…but not all at once. Instead, she sets up a 15-year, 5% TRCUT for their benefit through her estate plan and gifts the asset to the TCRUT.

- Grandma’s estate receives a $234,000 charitable estate tax deduction.

- Grandkids receive $25,000 annually, totaling $400,000 over the 15 year trust term.

- With proper management, the TCRUT will pay your heirs income that is taxed at favorable tax rates.

- Grandma has peace of mind knowing the grandkids cannot spend it all at once and the joy of knowing two of her favorite charities will benefit when the trust ends.

- She has “given it twice”. Her grandkids receive $400,000 in income, and her favorite charities receive nearly $600,000 in principal. That is a total gift to heirs and charity of $1,000,000!

If you are looking for a simple tax-wise way to provide for family and charity, then the Give-It-Twice trust strategy is worth considering.

If you would like to see an illustration of the benefits for you and your family, please contact Randal Daugherty, Director of Planned Giving at UT Southwestern and Southwestern Medical Foundation by calling (214) 648-3069.