Evaluate the Fit

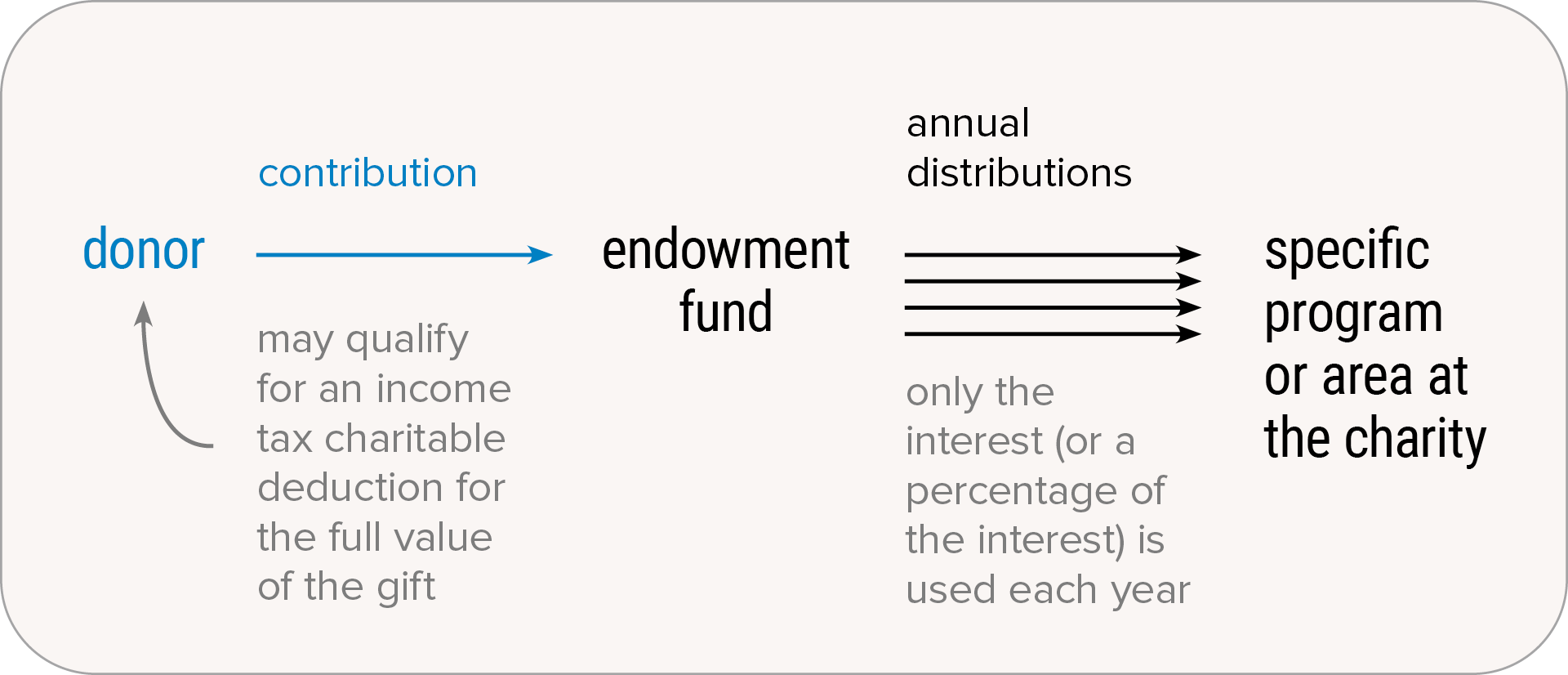

A gift to an endowment fund may be a particularly good option to consider if you want to:

- Qualify for a charitable income tax deduction

- Ensure the continuation of a particular part of our mission (say, a specific program or area)

- Make a lasting impact on UT Southwestern

- Help ensure that we have a steady level of support that can help us remain fully active during difficult economic times

See How it Works

Naomi, age 80, has given Southwestern Medical Foundation regular annual gifts of $1,200 since she retired at age 65. This year, however, she’s been thinking about her legacy. She decides to make a $25,000 gift to our endowment fund in memory of her late husband, Ken. Not only will her gift generate approximately the same annual donation ($1,250, assuming fund earnings of 5%), but Naomi knows her gift will help sustain the hospital that cared for Ken many times throughout his life.

Because she is also passionate about supporting UT Southwestern Medical Center, Naomi talks to her family and friends about her gift. Several of them make their own contributions to the endowment in Ken’s memory, creating an even more powerful and lasting impact.