Evaluate the Fit

A CRT may be a particularly good option to consider if you want to:

- Make a major gift and gain immediate income tax benefits, all without a loss of spendable income

- Make a significant property gift but don’t want to lose the income produced by the asset

- Convert an appreciated asset into an income stream

Older donors interested in the steady income of a charitable remainder annuity trust should compare the trust with a charitable gift annuity, which may be able to provide higher income payments.

“Give it twice” Trust

If you want to provide for your family and us after your death, a CRUT you create in your will (often called a “give it twice” trust) is worth considering. A “give it twice” trust, officially known as a testamentary CRUT, lets you provide for your family after your death and then support our important mission. It works like this:

- You include provisions in your will to create and fund the CRUT (many people fund the trust by simply naming the trust as the beneficiary of their retirement accounts).

- When you die, the selected assets will go into the trust and your spouse, children, or other named beneficiaries will receive payments for life (or a period up to 20 years).

- At the end of the trust term, the remaining trust assets will be distributed to Southwestern Medical Foundation to help further medical education, research, and patient care.

See How it Works

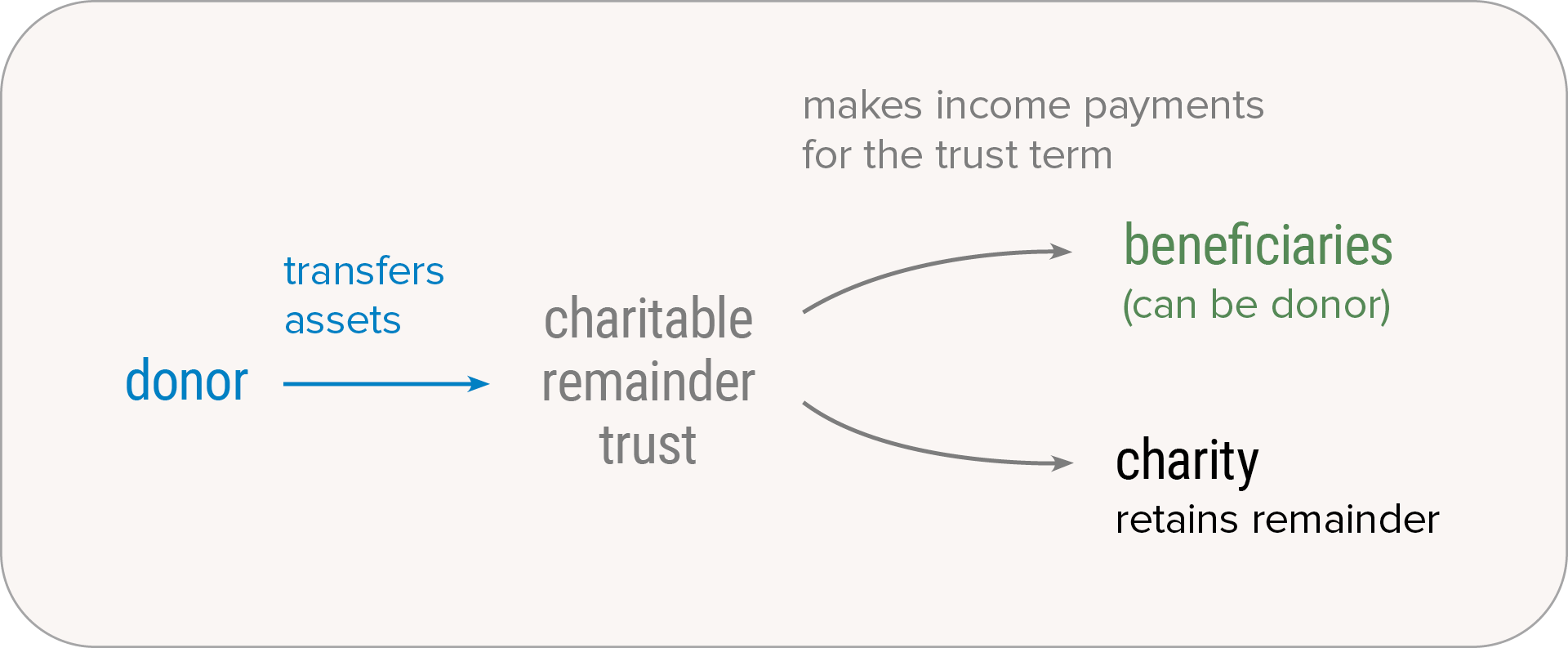

Ginny transfers highly appreciated assets worth $400,000 to a charitable remainder trust, specifying that $20,000 will be paid to her each year for as long as she lives. When Ginny dies, the remaining property in the trust will be distributed to Southwestern Medical Foundation. By using a CRT to make her gift to us, Ginny receives a few important benefits:

- An annual income of $20,000 for life

- An immediate and substantial income tax deduction if she itemizes

- No capital gains tax due when she transfers the appreciated property to the trust or even when the trustee sells the property to fund the income payments