Evaluate the Fit

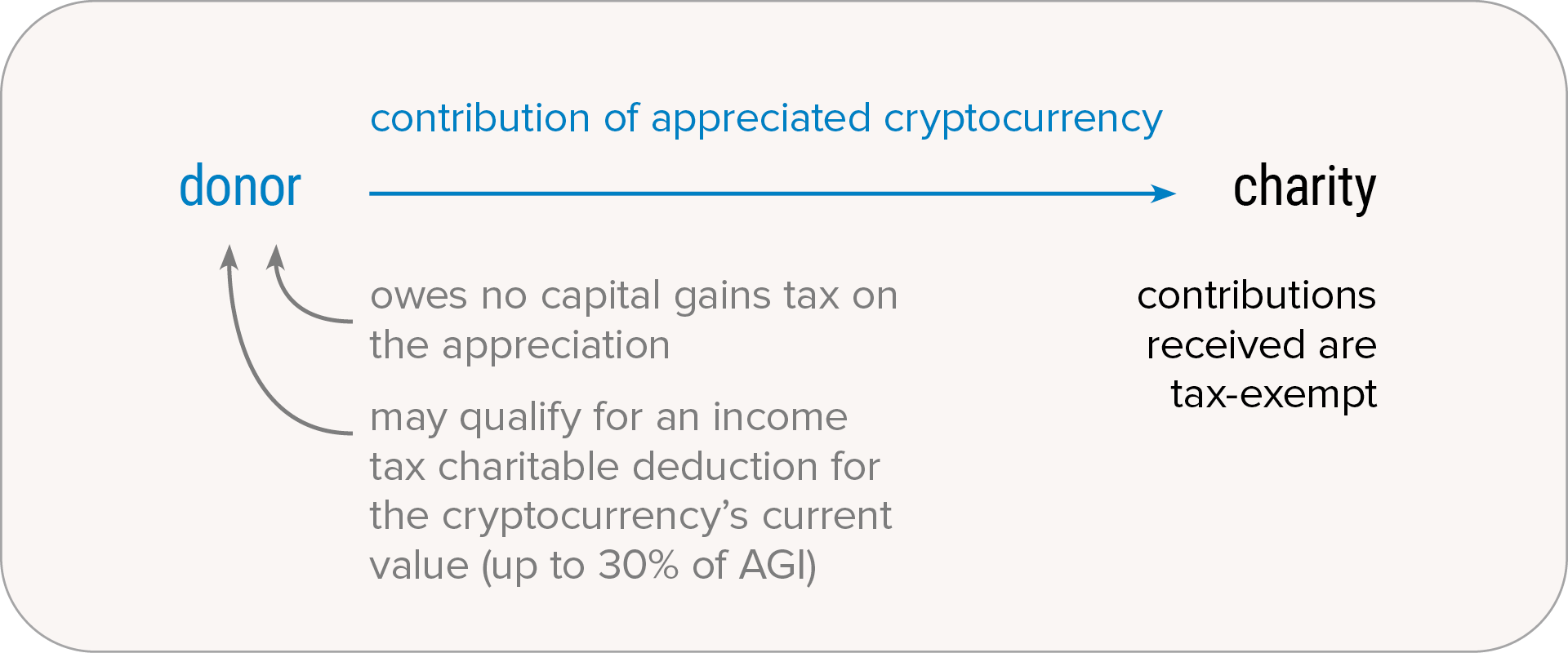

Cryptocurrency held for more than one year may be a particularly good gift option to consider if you:

- Own appreciated digital currency

- Want to bypass the capital gains tax on the significant appreciation

- Want to take a federal charitable income tax deduction for the full amount of your gift

See How it Works

For the past few years, Liam has given Southwestern Medical Foundation a check for $10,000. This year, he realizes that the cryptocurrency he purchased three years ago as an investment has significantly increased in value. He decides to give the Foundation digital currency worth $10,000 that he purchased for $1,000. If Liam itemizes, he may be eligible to take a deduction for the full $10,000, even though $9,000 of it has never been taxed. In his 37% tax bracket, the tax savings are substantial.

|

Gift of Cash |

Gift of Cryptocurrency |

| Liam’s gift |

$10,000 |

$10,000 |

| Income tax savings (37% tax bracket) |

$3,700 |

$3,700 |

| Capital gains tax savings (23.8% of $9,000) |

— |

$2,142 |

| Tax savings generated by Liam’s gift |

$3,700 |

$5,842 |