Evaluate the Fit

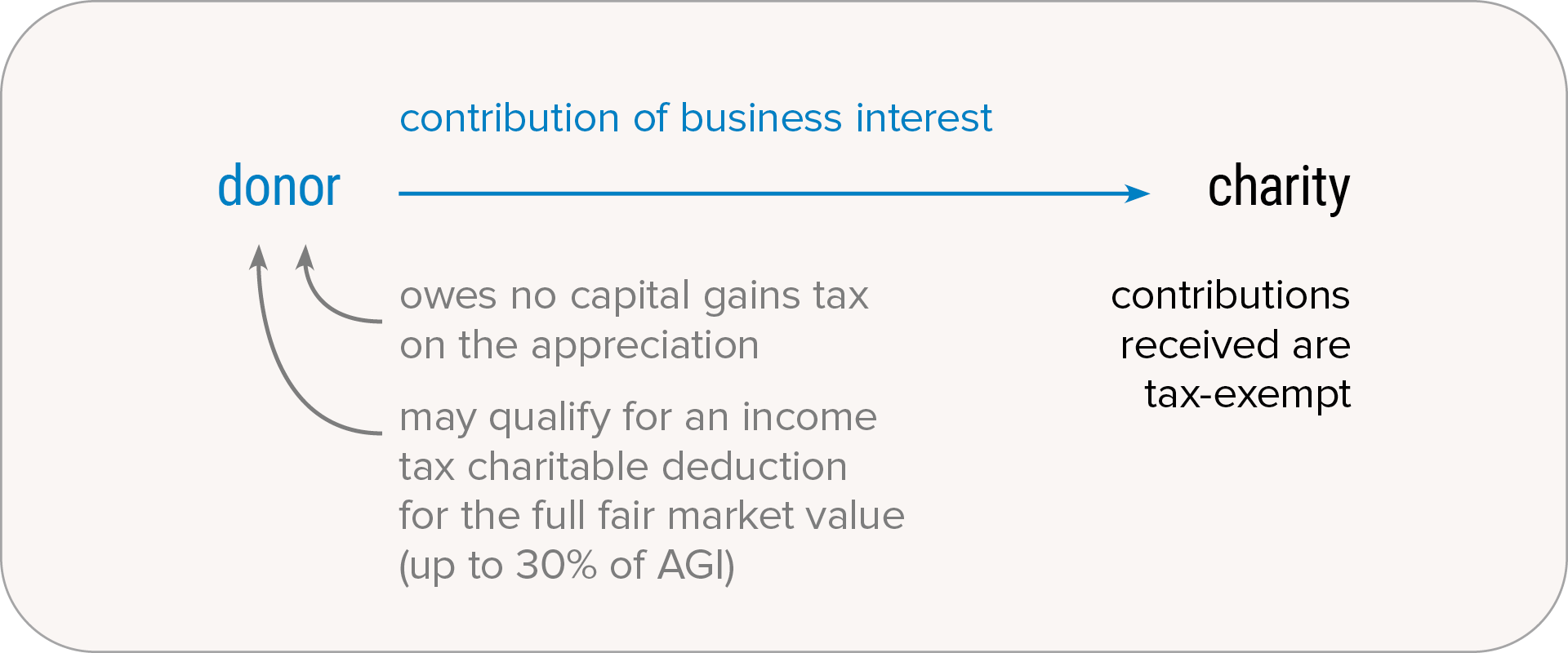

A gift of a business interest may be a particularly good option to consider if you are considering selling your business and you want to:

- Meet significant philanthropic goals

- Qualify for a double tax benefit—a charitable income tax deduction (if you itemize) and no capital gains tax on the appreciated value of the business interest

See How it Works

Claire owns a successful business with privately held stock. Her cost basis is $0, and the stock is currently valued at $27 million (based on a qualified appraisal). Claire decides to use $9 million of stock to support Southwestern Medical Foundation. She could sell the shares (subject to capital gains tax and possibly net investment income tax) and donate the proceeds. However, her advisor recommends considering a direct donation of the stock, which would mean bypassing taxes and making a more substantial gift.

Claire knows several investors who are greatly interested in the stock, but she has not begun any substantive discussions about a sale, nor has she entered into any type of agreement to sell the stock. Claire works with us, her legal counsel, and her advisor to directly donate the stock.

|

Sale then Donation

|

Direct Donation to Charity

|

| Value of Stock |

$9,000,000

|

$9,000,000

|

| Capital Gains Tax (20%) |

1,800,000

|

0

|

| Potential Net Investment Income Tax |

342,000

|

0

|

| Actual Gift Amount |

$6,858,000

|

$9,000,000

|

By donating the stock directly to us, Claire increased her gift by $2,142,000. Following the donation, Southwestern Medical Foundation initiated discussions with the interested investors to arrange a sale of the stock.