Evaluate the Fit

A gift in your will may be a particularly good option to consider if you:

- Are interested in a simple, powerful gift that costs you nothing today

- Want the flexibility of a gift you can change in the future if your situation or goals change

- Are seeking ways to reduce any potential estate tax (a gift in your will qualifies for an estate tax charitable deduction)

- Are looking at options to fund an endowment gift, testamentary charitable remainder trust, or testamentary charitable lead trust

Don’t Have a Will? Consider the Consequences

Do you find yourself in the half of all Americans who do not have a will? Whatever your age or the amount of your assets, if you die without a valid will or living trust to specify the distribution of your property, state law takes over without any consideration for your unique personal situation and wishes. Here are just a few of the downsides of not having a will:

- Your spouse may not get as much as you expect (in many states, the spouse and children will each take equal shares of the estate under state law).

- A child or other relative with special needs will not be given any special financial consideration.

- Meaningful heirlooms or other belongings will not automatically go to their intended recipients.

- The court-appointed guardian for any minor children and/or children with special needs may not be the person you would have chosen.

- The court-appointed estate administrator will likely not be the person you would have chosen.

- Estate administration becomes more difficult without clear direction, allowing fees to accumulate and shrink the total estate.

- If you have no heirs and no will, the state can end up with your entire estate.

- For larger estates, you forgo the chance to implement measures to reduce any potential estate tax.

- You will lose the opportunity to direct assets to those charitable organizations you would like to acknowledge and support as part of your legacy.

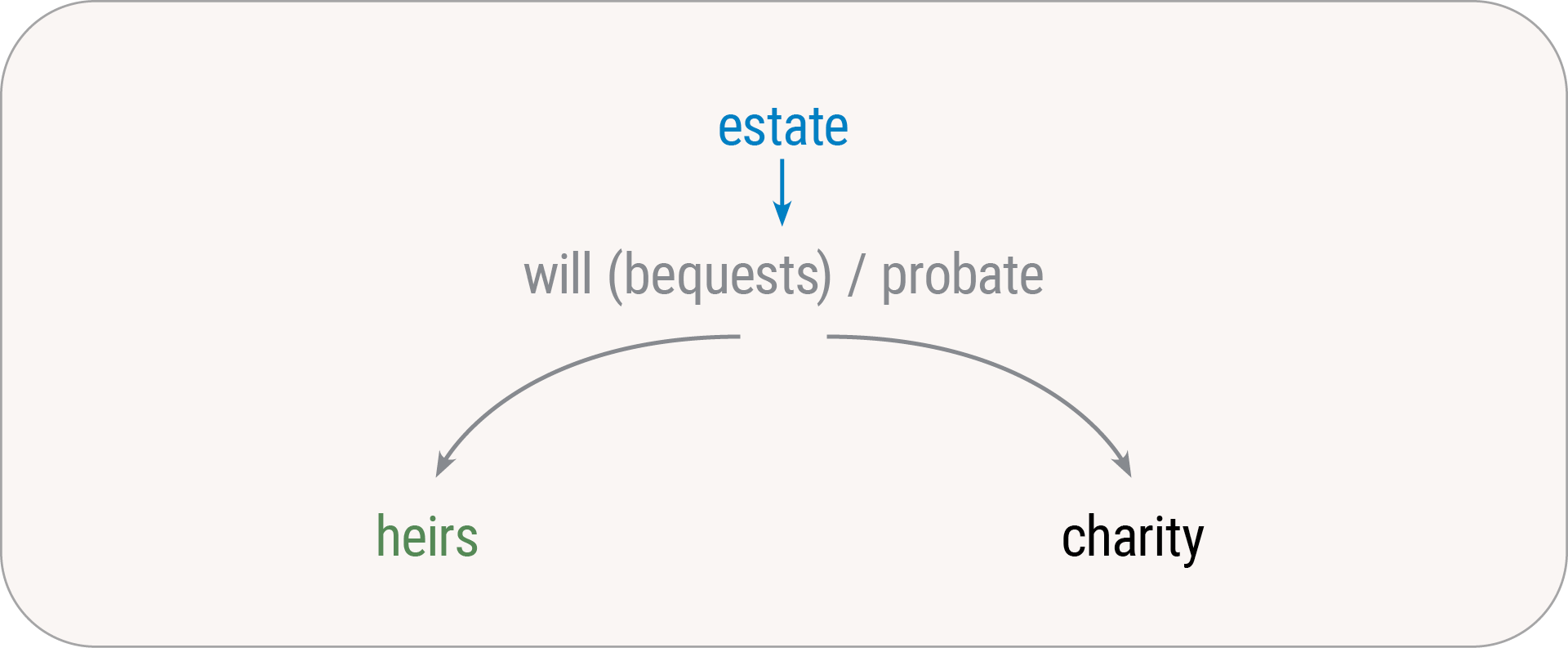

See How it Works

Grace wants to include a charitable gift to Southwestern Medical Foundation or UT Southwestern Medical Center in her will. She considers making a specific donation of 100 shares of stock but realizes this gift will surely change in value over time—perhaps significantly. Instead, she decides to leave a percentage gift—40% of her estate to each of her two children and 20% to Southwestern Medical Foundation for the benefit of UT Southwestern Medical Center. When Grace dies, her executor will carry out her wishes by distributing her assets according to her instructions.