Planning Tip:

Your will controls most property, but not all.

If you would like to make a similarly easy, flexible, revocable gift of other assets not named here, consider making a gift in your will.

Planned Giving

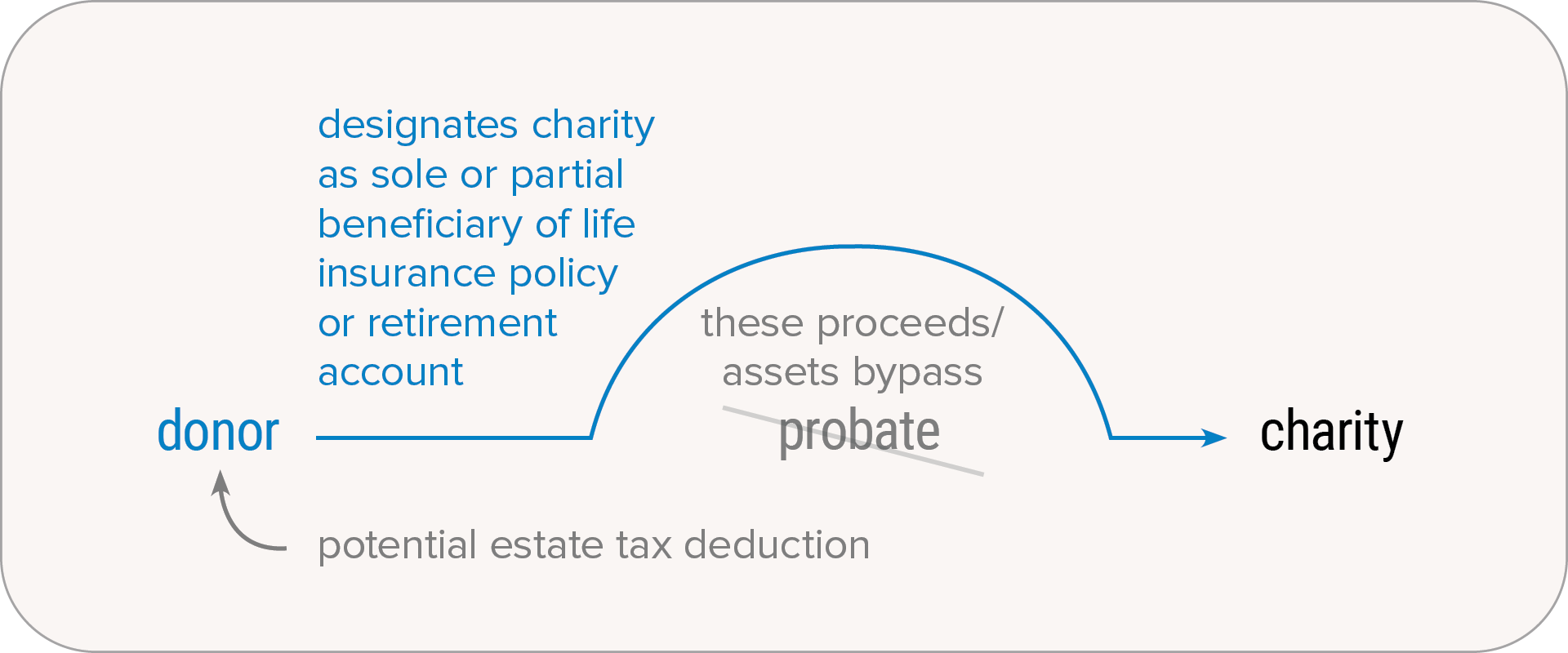

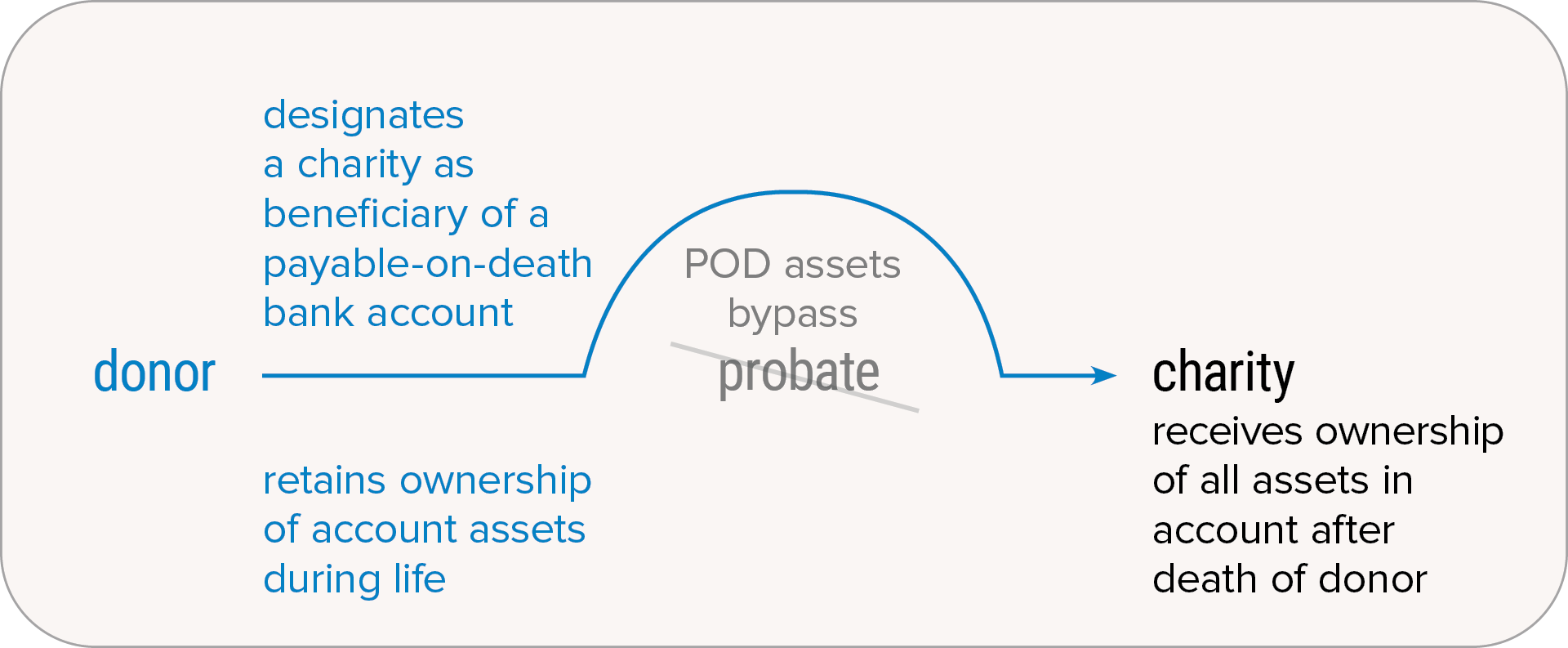

You may find that creating a gift that you can change if you need to is a comfortable, powerful way to make a meaningful gift while keeping control of the gift property for life. The following assets can pass directly by beneficiary designation and not under your will:

A charitable beneficiary designation works like this:

Planning Tip:

If you would like to make a similarly easy, flexible, revocable gift of other assets not named here, consider making a gift in your will.

A charitable beneficiary designation may be a particularly good option to consider if you:

Years ago, when David’s wife died, he filed a Change of Beneficiary form on his life insurance policy, making his two grown children the primary beneficiaries and Southwestern Medical Foundation a contingent beneficiary (to receive the proceeds only if his children could not). Now, both children are married with families of their own and are doing well financially. David plans to leave other assets to them and makes us the sole beneficiary of his life insurance policy. This allows him to meet his charitable goals while still retaining all his assets for use during retirement. In addition, he knows that if his situation changes, he can easily make another beneficiary change.

Carla adds a POD designation to her checking account and names Southwestern Medical Foundation as the beneficiary. She retains complete control of the account and can change the beneficiary designation again at any time during her life. While the FDIC insures her other accounts and CDs at the same bank for a combined total of $250,000, her POD account has its own $250,000 coverage. At Carla’s death, we must provide a certified copy of her death certificate to claim the money that remains in the account, which will then pass directly from the bank to us without going through probate.

Because no charitable deduction is available for this type of future gift, you can create or change a charitable beneficiary designation at any time that works for you.

We can answer any questions you may have about this gift option. If you have already named us as the beneficiary of an asset or account, please let us know.

"*" indicates required fields

Using a beneficiary designation to make a gift to Southwestern Medical Foundation qualifies you for membership in The Wildenthal Society. This is our way to thank you for supporting our future as your plan for yours. Read more about the The Wildenthal Society.