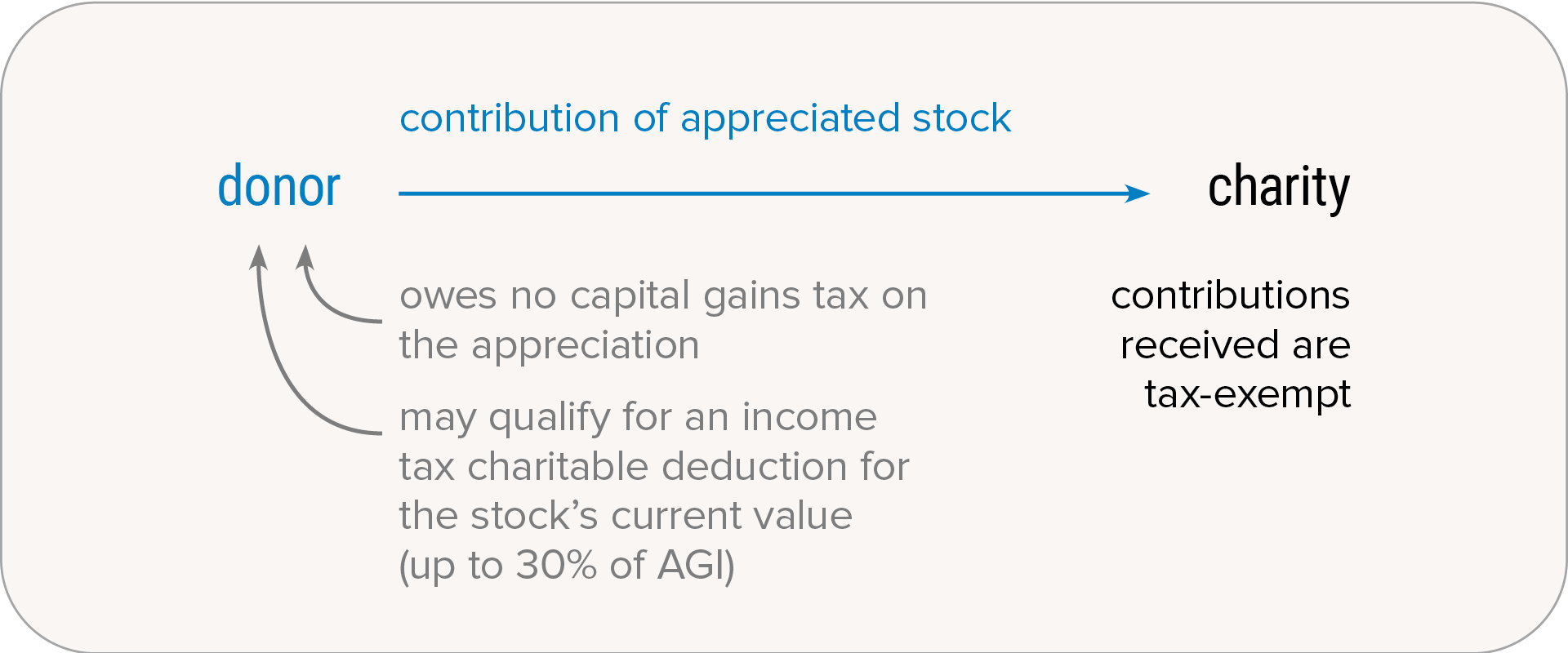

OPTION 2: Funding a Life-income Gift with Appreciated Stock

Another option is to use appreciated stock to fund a life-income gift, such as a charitable gift annuity or a charitable remainder trust. Benefits include:

- You qualify for an income tax deduction (if you itemize) in the year of the gift.

- You create an income stream to supplement other sources of retirement income—income that is likely to be higher than any dividends you might be receiving from the stock.

- You may be able to reduce or spread out the payment of capital gains tax on the appreciation.

Evaluate the Fit

Appreciated stock may be a particularly good option to consider if you:

- Have stock you want to sell, but you don’t want to pay tax on the significant appreciation

- Want to rebalance your portfolio

- Want to employ one of the most powerful gifting options with double tax benefits

See How it Works

For the past few years, Jennifer has given Southwestern Medical Foundation a check for $10,000. This year, she realizes that the growth of some of her stocks has caused her investment portfolio to become too heavily weighted in equities. She decides to give us stock worth $10,000 that she purchased years ago for $1,000. If Jennifer itemizes, she can take a deduction for the full $10,000, even though $9,000 of it has never been taxed. In her 37% tax bracket, the tax savings are substantial.

|

Gift of Cash |

Gift of Stock |

| Jennifer’s gift |

$10,000 |

$10,000 |

| Income tax savings (37% tax bracket) |

$3,700 |

$3,700 |

| Capital gains tax savings (23.8% of $9,000) |

— |

$2,142 |

| Tax savings generated by Jennifer’s gift |

$3,700 |

$5,842 |